expanded child tax credit build back better

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. The expanded child tax credit last year slashed poverty and tested a model of cash aid widely shared to families with no strings attached.

5 Elements For Building Trust In The Workplace Workplace Quotes Nursing Leadership Build Trust

An effort to extend the credit for one year was included in the Build Back Better bill a nearly 2 trillion climate policy and social spending plan.

. As Build Back Better is stalled in the Senate many families who received the monthly child tax credit payments in 2021 will need to find alternative ways to get by without this added benefit. Because the Build Back Better agenda was not passed by the Senate before the end of the year the last payment of the expanded child tax credit program went out this month. The president and many Democratic lawmakers intended to extend the more generous child tax credit for several more years and make certain provisions permanent through the Build Back Better bill.

The child and dependent care tax credit as its called was expanded in several ways for 2021 alongside other tax changes. The centers estimates. Joe Manchin of West Virginia is refusing to endorse the CTC extension and overall bill without limiting the payment to households with at least one working parent getting a W2 or.

Child tax credit benefits reached 612 million children by the year end. Sentiment on the expanded child tax credits expiration. Parents or guardians with at least one child under 18 in the household made up 27.

The expanded child tax credit was in place for the last. The senators said the expanded tax credit represented. The American Rescue Plan Act of 2021 temporarily expanded the child tax credit for 2021 only.

Expanded Child Tax Credit. The money in total supported 61 million children. President Bidens Build Back Better agenda calls for extending this tax relief for years and years.

Since July of 2021 this provision sent low-income families monthly payments of 300 per child under six years old and 250 for a child under 17 years old. Joe Manchin D-WV who scuttled the Build Back Better package in the Senate. But in December Congress left Washington for winter recess without passing President Bidens Build Back Better agenda which included an extension of the expanded child tax credit or CTC.

Beyond child care support Build Back Better also includes the permanent expansion of the Child Tax Credit which expired in 2022. The legislation passed in the House in November but has since stalled in the Senate. But the monthly payments lapsed in December 2021 as Democrats Build Back Better Act imploded leaving millions of working families without the payments that had become a lifeline amid the COVID-19 pandemic and decades-high inflation.

The credit increased from 2000 per child in 2020 to 3600 for each child under age 6. Last year the Internal Revenue Service IRS paid out six months of advance CTC payments starting in July worth up to 250 per child ages 6 to 17 and up to 300 per child under 6. This expanded tax credit kept 37 million children out of poverty in December according to calculations from the Columbia University Center on Poverty and Social Policy.

The president and many Democratic lawmakers intended to extend the more generous child tax credit for several more years and make certain provisions permanent through the Build Back Better. Anything that passes would likely require the support of Sen. To get money to families.

This expanded credit would help an. First the law allows 17-year-old children to. While Bidens Build Back Better BBB bill has proposed funding that will allow the expanded child credit to be paid in monthly installments in 2022 it has been held up in Congress as Sen.

The final payment for the expanded tax credit was distributed Dec. Romney Proposes Compromise to Child Tax Credit in Build Back Better by Stephen Silver The expanded child tax credit which was a key provision of last years American Rescue Plan Act expired at. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

To get a foothold and build a bright future for my kids I need Congress to pass paid leave create. Another 555 billion goes toward climate change mitigation 335 billion to expand health care benefits and 200 billion to mostly temporarily. In West Virginia The Enhanced Child Tax Credits Lapse Runs Deep.

For each child ages 6 to 16 its increased from 2000 to 3000. This means many families will get a. Without passage of the Build Back Better package the credit reverts to its smaller pre-pandemic form and there will be no monthly payments.

The payments initially reached 593 million children in July and eventually 612 million children at year end an. Democrats roughly 2 trillion Build Back Better spending bill which would have renewed the expanded credit into this year. Extend for one year the current expanded Child Tax Credit for more than 35 million American households with monthly payments for households earning up to 150000 per.

Among the new spending and tax breaks the Build Back Better Act spends roughly 585 billion to provide universal pre-K establish an affordable child care program and create a paid family and medical leave program. The expiration of that benefit however and Congress inability to pass the Build Back Better agenda that would have cemented the child tax credit for. As a young mother theres no question.

It also makes 17-year-olds eligible for the 3000 credit.

Lithia Motors Says Q4 Net Income Soars 55 As Revenue Sets Record In 2022 Net Income Income Soar

What You Should Know About The Employee Retention Credit Employee Retention Employee Payroll

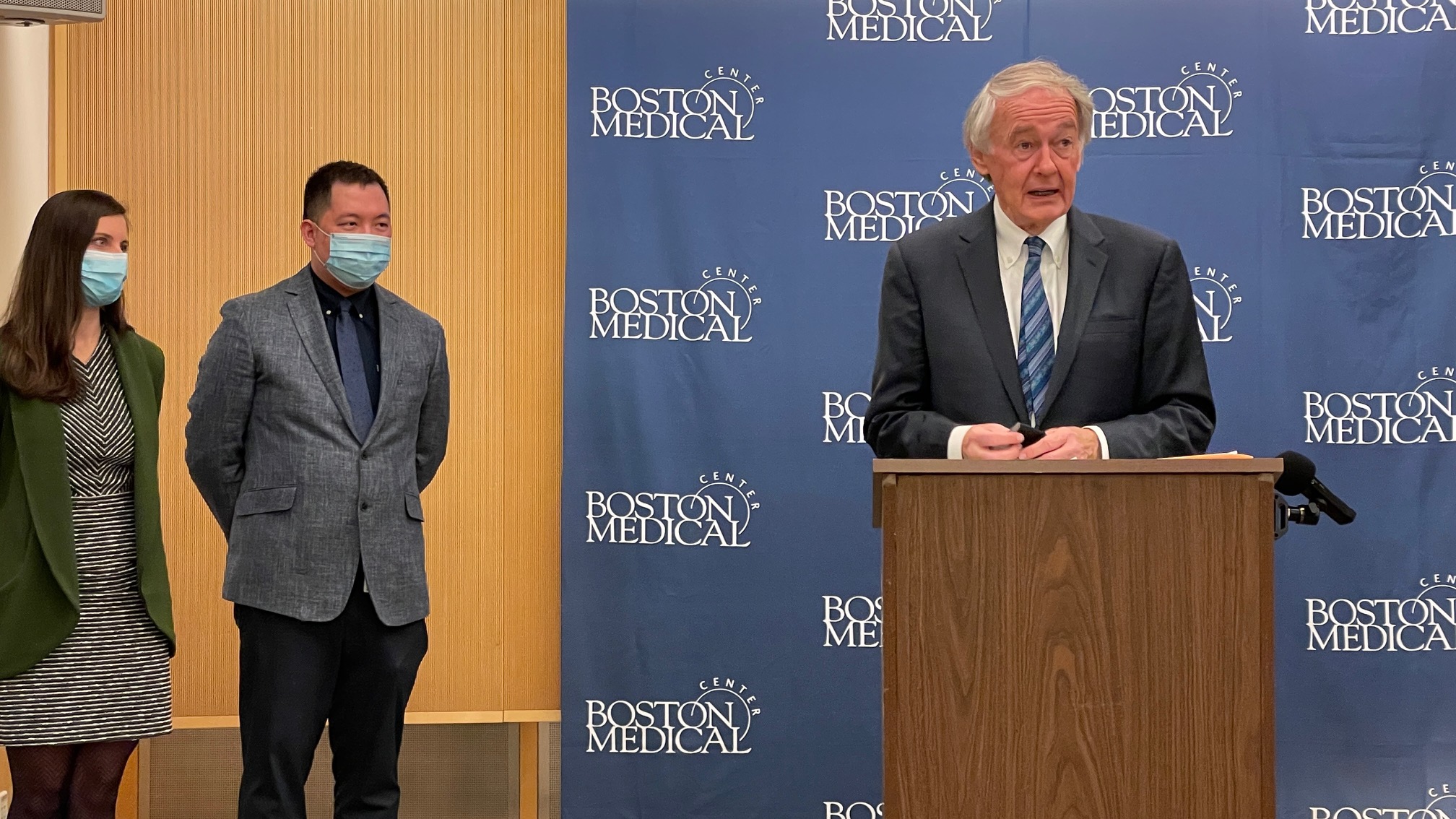

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Biden S Infrastructure Bill Will Bring Jobs Build Back Better Is Aimed At Reducing Inequities The Washington Post

The Build Back Better Act Would Greatly Lower Families Child Care Costs Center For American Progress

Adoption 101 The Adoption Tax Credit Tax Credits Adoption Tax

The Build Back Better Act Would Greatly Lower Families Child Care Costs Center For American Progress

The Data That Shows Boomers Are To Blame For The Labor Shortage In 2022 Child Tax Credit Child Care Worker Forced Labor

Tax Incentives Estate Tax Commercial Real Estate Tax Credits

Ca Inter And B Com Notes Income Tax House Property Income Tax Cost Accounting Income

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Gentex Q4 Net Income Plunges 41 In 2022 Net Income Plunge Income

13 Ways To Save Money On A Low Income Saving Money Ways To Save Money Saving Goals

Setting Your Child Up To Be A Millionaire Roth Ira Saving For Retirement Finance Investing

Exploring Financial Systems Trying To Decide If I Want To Use A Credit Union Or Use A Credit Unions Vs Banks Credit Union Marketing Financial Literacy Lessons

Credit Report Template Free Printable Documents Annual Credit Report Credit Bureaus Credit Report

How To Identify Old House Styles House Styles Cape Code Style House Old House